Introduction

The semiconductor industry is one of the major contributors to modern economic growth.1 As one recent National Academies’ study notes2:

“…often called the ‘crude oil of the information age,’ semiconductors are the basic building blocks of many electronics industries. Declines in the price/performance ratio of semiconductor components have propelled their adoption in an ever-expanding array of applications and have supported the rapid diffusion of products utilizing them. Semiconductors have accelerated the development and productivity of industries as diverse as telecommunications, automobiles, and military systems. Semiconductor technology has increased the variety of products offered in industries such as consumer electronics, personal communications, and home appliances.”

This pervasiveness in use establishes semiconductors as the premier general-purpose technology of our post-industrial era.3 In its impact, the semiconductor is in many ways analogous to the steam engine of the first industrial revolution.4

The invention of the first transistor in 1947 at Bell Telephone Laboratories heralded the beginning of the modern era in technological advancement. Four years later, in 1951, Bell Labs sponsored a conference in which the capabilities of the transistor were demonstrated to leading scientists and engineers for the first time. Although the attendees from outside Bell Labs did not yet possess the capability of producing a transistor, the conference conveyed the enormous potential of transistors, and many eager scientists returned in the spring of 1952 for the Bell sponsored Transistor Technology Symposium.5 The foundation of the modern day high-tech revolution was established at this symposium as the attendees shared their knowledge and ideas about the capabilities and applications of the transistor. Bell Labs assembled the knowledge shared at the eight-day conference into two volumes, entitled Transistor Technology.6

As a matter of antitrust settlement and corporate policy, in 1955 Bell Labs established an important precedent in creating the merchant semiconductor industry through a decision to share its intellectual property on diffused-base transistor technology.7 This decision allowed other researchers access to the knowledge describing methods for creating this new technology. Four years later, in 1959, the first integrated circuit (IC) was created, and the semiconductor industry began its rapid ascent from the cradle of the research lab to become the largest value-added manufacturing industry in the United States.8

SUSTAINED, PREDICTABLE GROWTH

The scale of this industry’s growth—exceptional both because of its rapidity and its predictability over time—and its contributions to the economy are not always fully appreciated. The U.S. Semiconductor industry is a major generator of high-wage jobs, employing 283,875 in 2000. The industry’s sales reached $102 billion9 in a global market estimated at $204 billion. The value of U.S.

|

5 |

For a more in-depth discussion of the events leading up to the Technology Transistor Symposium, go to: <http://www.pbs.org/transistor/index.html>. See also the Institute of Electrical and Electronics Engineers website, which also gives an excellent account of the transistor’s history. < http://www.ieee.org/organizations/history_center/>. |

|

6 |

Ibid. The book also became known as “Mother Bell’s Cookbook.” |

|

7 |

For an excellent description of the early evolution of the semiconductor industry see Kenneth Flamm Mismanaged Trade? Strategic Policy and the Semiconductor Industry, Washington, D.C.: Brookings Institution Press, 1996, pp. 30-31. See the paper by Thomas Howell, “Competing Programs: Government Support for Microelectronics,” in this volume. |

|

8 |

Source: U.S. Census Bureau, Annual Survey of Manufactures, 1999, Statistics for Industry Groups and Industries, Series M99(AS)-1, in Statistical Abstract of the United States; 2001, 121st edition. U.S. Census Bureau, U.S. Department of Commerce. |

|

9 |

Global market sales in 2000 were about $204 billion according to the SIA (Semiconductor Industry Association). For more information on the semiconductor industry, see <http://www.semichips.org/ind_facts.cfm>. |

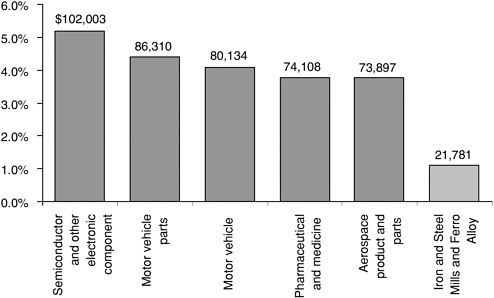

FIGURE 1 Semiconductor Value Added: Largest Five Value-Added Manufacturing Industries Compared with Other Major Sectors (Value Added as a Percentage of Value Added by Manufacturers—1999).

SOURCE: US Census Bureau, Annual Survey of Manufacturers.

semiconductor sales has averaged 50 percent of total worldwide sales in the past six years.

The semiconductor industry in 1999 was the largest value-added industry in manufacturing—almost five times the size of the Iron and Steel sector in that year (see Figure 1). It is, in fact, larger in terms of valued added than the Iron and Steel and Motor Vehicle industries (excluding Motor Vehicle Parts—a separate industry classification) combined. As noted below, the electronics industry, largely based on semiconductors, is the largest U.S. manufacturing industry.10

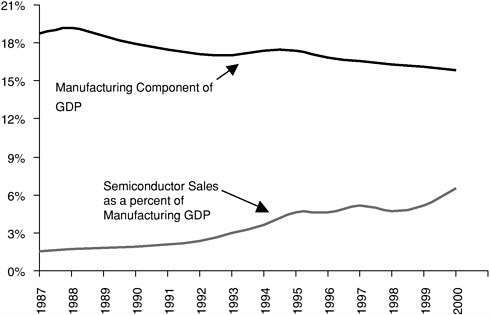

While the manufacturing sector’s contribution to GDP has been shrinking (accounting for just under 16 percent of GDP in 2000), U.S. semiconductor industry sales, as a percentage of output in the manufacturing sector, have increased steadily in the past 15 years, climbing from 1.5 percent of manufacturing GDP in 1987 to reach 6.5 percent in 2000 (See Figure 2).11

FIGURE 2 Semiconductor Sales as a Percent of Manufacturing GDP.

SOURCES: Semiconductor Sales; SIA GDP; Bureau of Economic Analysis.

These positive trends reflect the strong global economic position of the U.S. industry in a technology which is seen as fundamental to the economy. Given the industry’s contribution to economic growth, other countries have taken a proactive approach to encouraging the development of their national semiconductor industries in order to ensure themselves a place in the technologies that underpin the knowledge-based economy.12

The growing impact of information technologies on economic growth, in large part the result of improvements in semiconductors, has attracted increased attention from leading economists. Yet, the underlying technological challenges facing the semiconductor industry pose a complex set of issues for both the industry and national policy. If the U.S. and global economy are to continue to benefit from the vast increases in semiconductor power characterized by Moore’s Law, a series of impending technical challenges must be overcome. How these challenges are addressed will likely affect future national U.S. competitiveness and leadership in this enabling industry. The first firm, or geographically con

centrated group of firms, that resolves the technical challenges facing the industry could develop a position of leadership in semiconductor design and production in the years ahead.

To help their companies meet these technical challenges, a number of countries are making substantial public investments in cooperative R&D. In addition, other firms are pursuing strategies that may ultimately challenge the current business models of U.S. firms.

EARLY PUBLIC SUPPORT FOR THE INDUSTRY

The birth and proliferation of the semiconductor was facilitated by substantial public support in transistor research. By 1952, the U.S. Army’s Signal Corps Engineering Laboratory had funded 20 percent of total transistor-based research at Bell Labs.13 The eagerness of the Defense Department to put to use this innovative and radical new technology encouraged the Signal Corps to fund half of the transistor work by 1953.14

Public support for the nascent semiconductor industry became more prevalent after 1955 when R&D funds were allotted to other companies after the U.S. Department of Justice’s ongoing antitrust suit against Bell Labs pressured Bell into sharing its patents on transistor diffusion processes.15 According to one estimate, the government directly or indirectly funded 40 to 45 percent of all industrial R&D in the semiconductor industry between the late 1950s and early 1970s.16 On the demand side, federal consumption dominated the market for integrated circuits (ICs), which found their first major application in the Minuteman II guided missile. In the 1960s, military requirements were complemented by the needs of the Apollo Space Program.17

Public support played a critical and catalyzing role in the development and initial growth of the semiconductor industry. The groundbreaking inventions that launched the industry were made at Bell Labs, which was in part sustained by U.S. communications policy as well as by defense funding.18 As the initial in

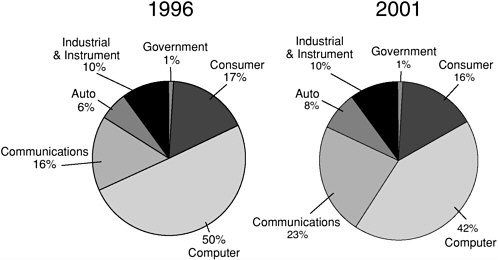

FIGURE 3 Worldwide Semiconductor End Use.

SOURCE: World Semiconductor Trade Statistics and SIA, September 2002.

vention revealed its potential, the government first encouraged the dissemination of the technology, then served as a source of sustained procurement for the most advanced products possible. This well-financed demand contributed directly to the early growth of the industry.19 In 1963, federal contracts accounted for 35.5 percent of total U.S. semiconductor shipments.20 Over the following decades, the semiconductor industry has grown enormously, and the government’s share of semiconductor consumption is now only about 1 percent of a much larger industry (see Figure 3).

THE ECONOMIC CONSEQUENCES OF “FASTER AND CHEAPER”

As noted above, the history of the semiconductor industry has been characterized by rapid growth, concurrently decreasing costs, and growing economic importance. For example, the industry is characterized by high growth rates, averaging 17 percent per annum.21 Semiconductors are also an enabling technol

|

19 |

See also Martin Kenney, Understanding Silicon Valley: The Anatomy of an Entrepreneurial Region. Stanford, CA: Stanford University Press, 2000. Government procurement continues to play a role, albeit a much smaller one. See Flamm, Creating the Computer: Government, Industry, and High-technology, Washington, D.C.: Brookings Institution, 1988 |

|

20 |

See Table 1-8 in Flamm, Mismanaged Trade? Strategic Policy and the Semiconductor Industry, p. 37. |

|

21 |

Semiconductor Industry Association, “World Market Shares 1991-2001,” Data for 1991-2000. San Jose, CA: Semiconductor Industry Association, 2002. See website: <http://www.semichips.org>. |

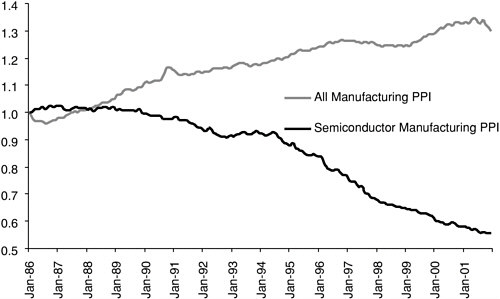

FIGURE 4 Semiconductor and All Manufacturing Producer Prices (Index 1986=1.00).

SOURCE: Producer Price Index, Bureau of Labor Statistics.

ogy with widespread and steadily growing applications (e.g., in medical technologies and research.)22 As semiconductor prices have steadily declined, investment in information technologies has increased.23 In the early 1950s, for example, a transistor was manufactured at a cost of between $5 and $45. Today, transistors on a microchip cost less than a hundred-thousandth of a cent apiece, which makes their marginal cost essentially zero.24 While the manufacturing sector as a whole has experienced an increase in prices since the mid-1980s, the semiconductor industry has exhibited a deflationary trend (Figure 4), which accelerated in the middle 1990s. The significance of this deflationary trend in semiconductor prices has not only made powerful consumer electronics products more

|

22 |

See National Research Council, Capitalizing on New Needs and New Opportunities: Government-Industry Partnerships in Biotechnology and Information Technologies, Washington, D.C.: National Academy Press, 2001. |

|

23 |

Semiconductor prices have declined at an annual rate of 30 percent in the past three decades. For an in-depth, technical discussion of semiconductor price evolution and its impact on information technology investment, see Jorgenson, op.cit. |

|

24 |

The exponential increase in power of the integrated circuit in the past several decades has been commensurately matched by a decrease in cost of each additional transistor on a chip. For a brief discussion of the decreasing cost of each new generation of integrated circuits, see National Academy of Engineering website; <http://www.greatachievements.org/greatachievements/ga_5_2.html>. |

accessible, but has spurred increased business investment in information technology, which has in turn catalyzed improvements in productivity.

The ability to increase device power and decrease device cost underlies the semiconductor industry’s growth. In 1965, just seven years after the invention of the integrated circuit, Gordon Moore predicted that the number of transistors that would fit on an integrated circuit, or chip, would double every year. He tentatively extended this forecast for “at least 10 years.” 25 At that time, the world’s most complex chip had 64 transistors. Dr. Moore’s extrapolation proved to be highly accurate in describing the evolution of the transistor density of a chip. By 1975, some 65,000 transistors fit on a single chip. More remarkably, Moore’s general prediction has held true to present day, when microcircuits hold hundreds of millions of transistors per chip, connected by astonishingly complex patterns.26

The implications of Moore’s Law have been far-reaching. Since the doubling in chip density was not accompanied by commensurate increases in cost, the expense of each transistor was halved with each doubling. With twice as many transistors, a chip could store twice as much data. Higher levels of integration meant that greater numbers of functional units could be placed onto the chip, and more closely spaced devices—such as the transistors—could interact with less delay. Thus, these advances gave users increased computer processing power at a lower price, consequently spurring chip sales and a demand for yet more power.27 Beginning in the late 1970s, the use of semiconductors became more pervasive, spreading from computers to air traffic control systems, microwave

|

25 |

See Gordon E. Moore, “Cramming More Components onto Integrated Circuits,” Electronics 38(8) April 19, 1965. Here, Dr. Moore notes that “[t]he complexity for minimum component costs has increased at a rate of roughly a factor of two per year. Certainly over the short term, this rate can be expected to continue, if not to increase. Over the longer term, the rate of increase is a bit more uncertain, although there is no reason to believe it will not remain nearly constant for at least 10 years. That means by 1975, the number of components per integrated circuit for minimum cost will be 65,000.” See also, Gordon E. Moore, “The Continuing Silicon Technology Evolution Inside the PC Platform,” Intel Developer Update, Issue 2, October 15, 1997, where he notes that he “first observed the ‘doubling of transistor density on a manufactured die every year’ in 1965, just four years after the first planar integrated circuit was discovered. The press called this ‘Moore’s Law’ and the name has stuck. To be honest, I did not expect this law to still be true some 30 years later, but I am now confident that it will be true for another 20 years.” |

|

26 |

Ibid. See also Michael Polcari’s presentation in the Proceedings, which discusses the progression of Moore’s Law. |

|

27 |

For a complete analysis of the impact of the increase in the power of the semiconductor accompanied by its subsequent decline in price, and its positive influence on economic growth, see Jorgenson, op.cit. See also G. Dan Hutcheson and Jerry D. Hutcheson, “Technology and Economics in the Semiconductor Industry,” Scientific American, <http://www.sciam.com/specialissues/1097solidstate/1097hutch.html>. |

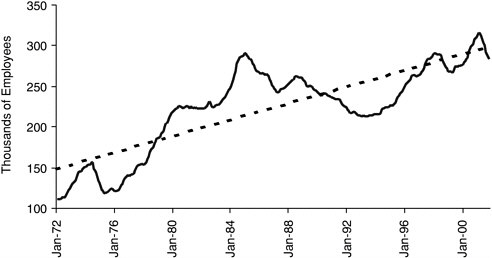

FIGURE 5 Employment 1972-2001: Semiconductor and Related Devices Industries.

SOURCE: Bureau of Labor Statistics, Form 790.

ovens, video cameras, watches, grocery checkout machines, automobiles, touch-tone phones, wireless communications, and satellite broadcasts.

A DRIVER OF MODERN INDUSTRY

The semiconductor has become the engine of growth for many fledging industries, as well as a source of revitalization and increased efficiency for more established industries (see Box A). Consequently, semiconductors, as well as related industries, have acquired significant global visibility and have become targets of national economic priority in many countries. As of August 2001, the semiconductor industry employed some 284,000 people in the United States alone.28 The industry, in turn, provides enabling technologies for the $425 billion U.S. electronics industry.29 Figure 5 exhibits the employment trends in Semiconductor and Related Device industries dating back to 1972. The cyclicality of the industry is evident, but employment has increased steadily by more than two-and-a-half times since 1972.

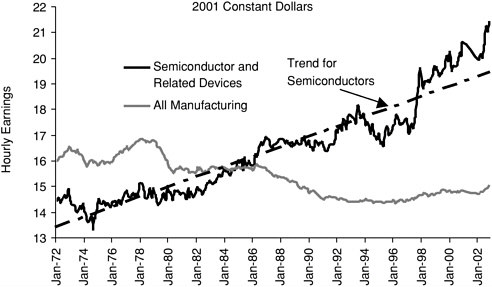

Importantly, the semiconductor industry is a substantial source of high-wage jobs. In addition to the increase in overall industry employment, real average

|

28 |

According to the Semiconductor Industry Association, the semiconductor industry employs some 283,875 within the U.S. See <http://semichips.org/ind_facts.cfm>. |

|

29 |

This recent estimate is from Cahners Business Information at <http://www.cahners.com/2001>. |

|

BOX A WHY DO NATIONAL POLICIES FOCUS ON THE SEMICONDUCTOR INDUSTRY? The semiconductor industry, characterized by yearly increases in performance and concurrent price decreases, has had a distinctive positive impact on the economy. It is—

|

FIGURE 6 Average Hourly Earnings 1972-2001: Semiconductor and Related Device Industries and All Manufacturing (2001 Constant Dollars).

SOURCES: Earnings—Bureau of Labor Statistics, Form 790; Consumer Price Index, All Items—Bureau of Labor Statistics.

hourly earnings in the semiconductor and related device industries, shown in Figure 6, have risen a remarkable 50 percent in the past 30 years—from roughly $14.50 in 1972 to about $21.50 today in 2001 dollars. This sizeable increase in real average hourly earnings for the semiconductor industry stands in stark contrast to the stagnation and then decline in real wages in the manufacturing sector as a whole over the same 30-year period. Real wages for the overall manufacturing sector declined by about 6 percent over this period.30

AN ENABLING INDUSTRY

Some believe that the advances in semiconductors and computers are responsible for the increases in productivity throughout the economy. For example, the semiconductor lies at the heart of the computer (desktop computers, workstations, servers, etc.), which is the foundation of increases in firm productivity and provides the platform for the Internet. The Internet subsequently provides the platform for the World Wide Web, which then provides a foundation for e-com

merce. In addition, the semiconductor drives the rapidly evolving world of wireless communication and a vast and growing universe of computer-enabled information digitization.

As was noted in the opening remarks of this symposium, the semiconductor industry carries an importance far beyond the specific trade, employment, and revenue figures of the industry itself. The industry is responsible for “much of the recent productivity gains in computers, communications, and software.”31

The “digital economy” and the corresponding positive synergistic relation to the remarkable period of productivity growth in the 1990s has been acknowledged by the Federal Reserve in its public discourse, as well as reflected in its monetary policy. During the middle part of that decade, Alan Greenspan, Chairman of the Federal Reserve Board, suggested that the nation’s expenditures on semiconductor-based products and the gains in productivity expected to accompany these expenditures characterize a far-reaching economic transformation:

We are living through one of those rare, perhaps once-in-a-century events….The advent of the transistor and the integrated circuit and, as a consequence, the emergence of modern computer, telecommunication, and satellite technologies have fundamentally changed the structure of the American economy.32

Reflecting this investment, high technology firms also create positive spillovers, which affect society in many ways. Spillovers benefit other commercial sectors by generating new products and processes that can lead to productivity gains. A substantial literature in economics underscores the potential for high returns from technological innovation; it shows private innovators obtaining rates of return in the 20 to 30 percent range and spillover (or social return) averaging about 50 percent.33

High-technology products are a major source of growth in the major industrialized countries. Sectors such as aerospace, biotechnology, and information systems contribute to the growing global market for high-technology manufactured goods. While subject to pronounced cyclical swings, high-technology firms are

also associated with high-value-added manufacturing and with the creation of high-wage employment.34 Together, these contributions provide the productivity gains that underpin recent economic performance.35

SEMICONDUCTORS AND PRODUCTIVITY

In the late 1970s and early 1980s, there was a significant loss in global market share by many U.S. industries to Japanese producers. An extensive literature in the social sciences has focused on the decline in U.S. industry during this period. One influential study reported that U.S. manufacturers in general had lost the ability to compete internationally, especially with Japan, and that the U.S. industrial weakness was part of a longer period of decline.36

Part of this pessimism was connected to the multi-decade trend of low productivity growth, loss of market share for many U.S. industries, and rapid growth in the trade deficit. Despite large investments in purported labor-saving systems—especially information technology—productivity remained low through the first half of the 1990s, just as it had since 1973. As recently as 1997, many economists were convinced of the validity of the so-called productivity paradox— Robert Solow’s casual but oft-repeated remark made in 1987: “We see the computer age everywhere except in the productivity statistics.”37

In the middle 1990s, however, several significant trends became apparent. One was the relatively rapid and widespread adoption of the Internet and other information technology (IT), which allowed not only individuals but also businesses to benefit from previously unavailable low-cost communication. Another was a sudden acceleration in the decline of semiconductor and computer prices. In a recent paper, Dale W. Jorgenson and Kevin J. Stiroh describe this acceleration as a “point of inflection,” where the price decline abruptly rose from 15 percent annually to 28 percent. In response to this rapid price decline, investment in computer technology exploded, and its contribution to growth rose more than

|

34 |

Laura Tyson, Who’s Bashing Whom? Trade Conflict in High Technology Industries, Washington D.C.: Institute for International Economics, 1992. For the impact of the telecommunication industry’s downturn on the semiconductor industry, see Richard Gawel, “Semiconductor Equipment Shipments Plummet 35%” Electronic Design, Aug 20, 2001, Volume: 49, Issue: 17, p. 38; and Bolaji Ojo, “IC Equipment Makers Batten Down—Focusing On Next-Generation Technology As Demand Plummets,” EBN, Jul 23, 2001, Special Volume/Issue: Issue: 1272, p.20. |

|

35 |

See Jorgenson and Stiroh, op. cit. For the most recent, as well as historical data on productivity, see Bureau of Labor Statistics website at <http://www.bls.gov/lpc/home.htm>. |

|

36 |

Robert M. Solow, Michael Dertouzos, and Richard Lester, Made in America, MIT Press, Cambridge, MA, 1989. |

|

37 |

Robert Solow, “We’d Better Watch Out,” New York Times Book Review, July 12, 1987. |

fivefold. Jorgenson and Stiroh find that computers contributed 0.46 percentage points to the 2.4 percent productivity growth in the period from 1995 to 1998.38 Software and communications equipment contributed an additional 0.30 percentage points per year over the same period. Preliminary estimates through 1999 revealed further increases for all three categories (computers, communications equipment, and software).39

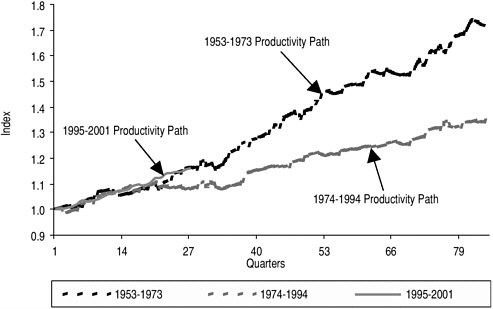

Jorgenson and Stiroh’s analysis builds the case for “raising the speed limit,” that is, for revising upward the intermediate-term projections of growth for the U.S. economy. They noted that after a 20-year slowdown, dating from the early 1970s, average labor productivity had grown by 2.4 percent per year during the period 1995-1998, exceeding the rate for 1990-1995 by a full percentage point. Even the most recent downturn in the U.S. economy seems to have left much of this increase in productivity intact.40 In short, Jorgenson and Stiroh’s research supports the notion that the economy is on a higher-productivity path, similar to that experienced from the early 1950s through the early 1970s, as suggested by Figure 7.

In related work, the National Research Council’s Board on Science, Technology, and Economic Policy produced an analysis examining what some see as the resurgence of U.S. industry.41 This analysis finds that over the previous 15 years, many industries in the United States had succeeded in regaining competitive positions relative to their counterparts abroad.42 Importantly, of the industries reviewed, over half had been transformed by the use of information technology, which rests fundamentally on developments in semiconductor technology and software. One sector of focus in this study is the U.S. semiconductor industry, which the research found to have returned to international pre-eminence by the late 1990s.43

In sum, the American economy has benefited from the contributions of the information technology industry, not least through its contributions to productiv

|

38 |

An MGI study is more cautious but finds that the semiconductor industry alone contributed 0.20 percentage points to the 1.33 percent jump in productivity from the 1995-1999 period. For more of MGI’s conclusions concerning the impact of the semiconductor industry on growth, see <http://www.mckinsey.com/knowledge/mgi/feature/index.asp>. |

|

39 |

Jorgenson and Stiroh, op.cit. See also National Research Council, Measuring and Sustaining the New Economy. |

|

40 |

“Productivity Growth May Be Here to Stay,” Wall Street Journal, January 7, 2002. p. A1. |

|

41 |

See National Research Council, U.S. Industry in 2000: Studies in Competitive Performance. |

|

42 |

In some cases the perceived decline of U.S. industry was overstated. See Macher, Mowery, and Hodges, op.cit. |

|

43 |

Ibid. For a discussion of the factors leading to the resurgence of the U.S. semiconductor industry, see below. |

FIGURE 7 Productivity Growth for Three Periods: 1953–1973; 1974–1994; 1995–2001.

SOURCE: Labor Productivity, Bureau of Labor Statistics.

ity.44 Leading researchers now believe that Solow’s paradox has been resolved.45 The information technology revolution is finally visible in productivity statistics.46 As the Council of Economic Advisers noted, “even though economists

differ as to the correct way to adjust for responses to the business cycle, the finding that a structural acceleration has taken place is robust.”47 The council finds that a breakdown of the sources of this accelerated productivity suggests three lessons:

-

“The information technology sector itself has provided a direct boost to productivity growth….;

-

“The spread of information technology throughout the economy has been a major factor in the acceleration of productivity through capital deepening…;” and

-

“Outside the information technology sector, organizational innovations and better ways of applying information technology are boosting the productivity of skilled workers.”48

The sustainability of this growth resurgence, however, depends on the rate of current and future technological progress, which itself depends on the level and effectiveness of the nation’s R&D investments, both private and public, as well as on the maintenance of supportive macroeconomic policy.49

TECHNICAL CHALLENGES AND SOARING CAPITAL COSTS

For more than 30 years the growth of the semiconductor industry has been largely associated with the ability to steadily and quickly shrink the transistor and increase its speed without increasing costs. If the increases in productivity observed since 1995 depend on the increases in semiconductor power characterized

by Moore’s Law, then a continuation of productivity increases will likely depend on the ongoing benefits associated with the process of “scaling” in microelectronics.50

Other challenges facing the industry include the need to substantially improve packaging technology in order to house and interconnect the next generation of chips emerging from the silicon foundries. Further, development and progress are also needed in the area of chip-level CAD (Computer Aided Design) tools as well. Absent dramatic innovation in these two areas, it may prove impossible to exploit the enhanced functionality, gate density, and speed of future semiconductor products, creating a disincentive for new-product adoption and leading to stagnation in semiconductor sales.51

The reduction in semiconductor size, however, may now be approaching important critical limits. In a recent paper, Paul Packan of Intel Corporation described some of these limits, including odd and undesirable quantum effects that appear under extreme miniaturization. For example, the gates that regulate the flow of electrons within semiconductor devices have become so short that electrons can tunnel through them even when they are closed. In addition, dopants, impurities mixed with silicon that increase its ability to hold localized charges, must be added in progressively higher concentrations as device size shrinks in order to enable them to hold the same charges. At a certain concentration, dopant atoms begin to interact with each other to form clusters that no longer hold a charge. Transistor dimensions have shrunk to such an extent that small changes in the exact number and precise distribution of individual dopant atoms can change the behavior of the device. Packan’s conclusion is expressed in sobering words:

“These fundamental issues have not previously limited the scaling of transistors and represent a considerable challenge for the semiconductor industry. There are currently no known solutions to these problems. To continue the performance trends of the past 20 years and maintain Moore’s Law of improvement will be the most difficult challenge the semiconductor industry has ever faced.”52

The industry also faces the additional challenge of the soaring cost of manufacturing chips. When Intel was founded in 1968, a single machine used to produce semiconductor chips cost roughly $12,000. Today a chip-fabricating plant costs billions of dollars, and the expense is expected to continue to rise as chips become ever more complex. Adding to this concern is the realization that capital costs are rising far faster than revenue.53 In 2000, for example, average total expenditures for a six-inch-equivalent “wafer” were $3,110, an increase of 117 percent over the average total costs for a six-inch wafer in 1989, and a 390 percent increase since 1978.54

The consensus in the engineering community is that improvements, both large and small, will continue to uphold Moore’s Law for another decade or so, even as scaling brings the industry very close to the theoretical minimum size of silicon-based circuits.55 To the extent that physical constraints or cost pressures limit the continued growth of the industry, however, they will necessarily influence the role of the industry in stimulating productivity growth in the broader economy. As capital costs rise, fabrication capacity increases, and alternative business models (e.g., the foundry system) gain prominence, the competitive position of some U.S. device manufacturers (e.g., the merchant semiconductor producers) may be challenged,56 while other U.S. firms may prosper in the new environment.

Greater Vertical Specialization: The Emergence of the Foundries and Fabless Firms57

Significant shifts are occurring in the semiconductor industry with a strong

|

53 |

Charles C. Mann, “The End of Moore’s Law?” Technology Review, May/June 2000, <http://www.technologyreview.com/magazine/may00/mann.asp>. |

|

54 |

These statistics originate from the Semiconductor Industry Association, 2001 Annual Databook: Review of Global and U.S. Semiconductor Competitive Trends, 1978-2000. A wafer is a thinly sliced (less than 1 millimeter) circular piece of semiconductor material which is used to make semiconductor devices and integrated circuits. |

|

55 |

See discussion by Bob Doering of Texas Instruments on “Physical Limits of Silicon CMOS and Semiconductor Roadmap Predictions,” at the National Academies Symposium, Productivity and Cyclicality in the Semiconductor Industry, held at Harvard University, September 24, 2001. |

|

56 |

See remarks by George Scalise, President of the Semiconductor Industry Association, at the National Academies Symposium; Productivity and Cyclicality in the Semiconductor Industry, held at Harvard University, September 24, 2001. |

|

57 |

Much of the information and description in this section is adapted from a presentation by D.A. Hodges and R.C. Leachman, “The New Geography of Innovation in the Semiconductor Industry.” For the full presentation, see <http://web.mit.edu/ipc/www/hodges.pdf>. See also R. C. Leachman and D. A. Hodges, “Benchmarking Semiconductor Manufacturing,” IEEE Transactions on Semiconductor Manufacturing, TSM-9, pp. 158-169 (May 1996). <http://radon.eecs.berkeley.edu/~hodges/BenchmarkingSM.pdf> |

trend toward more vertically specialized firms.58 This increased “vertical disintegration” means that more firms are either dedicating their resources to the manufacture of chips designed by others (the foundry model) or are choosing to specialize solely in the design of chips (the “fabless” firm).

Several factors are encouraging greater vertical specialization. For example, the opportunities now available in “system-on-a-chip” design, a focus on specialized markets, new market channels, and the different skill requirements for design and manufacture are all contributing to this trend.59 For design firms, the different time scales and levels of investment necessary for manufacturing have helped to accelerate the trend toward vertical specialization. Further accelerating these structural changes is the reduced attractiveness of niche markets for many Integrated-Device Manufacturers (IDMs). These structural shifts mean that effectively competing in the design and manufacture of chips requires differently skilled firm workforces making it difficult for some IDMs to competitively engage in both design and manufacturing.

Another major driver enabling the separation of design and manufacturing is the maturation and standardization of both electronic design automation and process technologies. These include CMOS (complimentary metal-oxide semiconductor) technology—the microelectronic technology used in almost all microprocessors, memory products, and application-specific integrated circuits (ASICS). More accurate physical process developments, more accurate process characterization for design, better software design tools, and the rise of foundries with state-of-the-art manufacturing technology have all facilitated this structural transformation.

Foundries

The manufacturing segment of the market is increasingly characterized by the foundry, whose focus is on high productivity and rapid turnaround from design to product. Foundries also permit production of smaller batches of specialized chips at commodity-like costs. These fabrication facilities (“fabs”), where firms produce semiconductors under contract with other companies, have expanded rapidly, particularly in East Asia. Taiwan Semiconductor Corporation (TSMC) and United Semiconductor Corporation (UMC) hold about 65 percent of global market share of foundry-based production, with firms from other Asian nations and the United States (IBM) holding the remainder.60 Tight quality control,

rigorous manufacturing discipline, a fast, standardized production process, and short cycle times are typical characteristics of a successful foundry. Such foundries also provide top-of-the-line Internet-based customer service, while also protecting proprietary customer designs. The big gain is that foundries permit firms to bring products to market without raising and investing the capital required for an advanced manufacturing facility. This model of production can offer substantial cost savings in manufacturing new generations of chips. These cost savings may be accentuated by lower capital costs that reflect the impact of preferential tax treatment and more direct government subsidies for industries that are viewed as strategic by government policy makers in countries such as Taiwan.61

Fabless Design Firms

The emergence of design houses or “fabless” firms—firms which specialize in the design of semiconductors only and do not produce them—is yet another sign of vertical specialization in the industry and functions congruently with the foundry model of production. The modest amount of investment necessary for market entry, the short time to market, and the prospect of rapid growth have established design firms as high-risk, high-reward entrepreneurial vehicles. This degree of specialization has also accelerated the pace of product innovation. Success in the design segment of the semiconductor supply chain is determined by providing the right product features at the right market time. The integration of system and circuit designers and the achievement of flawless design discipline are key to a successful design firm. Fabless firms also need access to high-quality manufacturing—through foundries—and for new design firms, a path to market entry.

Over time, the development of new technologies, especially manufacturing technologies, may become more closely associated with the foundries themselves. Significant technical capability and know-how may be transferred, particularly as design houses, such as those in Hsinchu Park in Taiwan, are increasingly involved. The consequences of this phenomenon are not clear, nor are they unidirectional. As noted above, in the near term, the availability of low-cost, high-quality fabrication facilities can work to the benefit of U.S. design firms.62 In periods of surplus manufacturing capacity, design firms can do well by benefiting

|

61 |

Because the foundry concept was considered risky at TSMC’s founding, 44 percent of TSMC’s initial capitalization was provided by the Taiwanese Cabinet’s Development Fund. See the discussion of foundries in Howell, op. cit. |

|

62 |

According to IC Insights, Inc. seven of the top fabless firms are U.S. based (e.g., Qualcomm, Nvidia, and Xilinx). See <www.siliconstrategies.com/story/OEG20020329S0036>. |

from the foundries’ rapid production of new products without bearing the burden of the long lead times and high fixed costs of modern fabs. Design firms may do less well in periods of high capacity utilization, particularly if they face competition in the same market from their suppliers. 63

The push toward vertical specialization contrasts with much of the U.S. industry, notably the merchant device manufacturers, which typically house both design and production under one roof. This specialization poses interesting questions for U.S. producers, and ultimately for the trajectory of the U.S. economy. As described below, much of the resurgence in the U.S. industry as a whole is derived from its renewed capability in manufacturing, combined with its strength in design. Improved manufacturing was central to the recovery of the industry, and manufacturing continues to play an essential role in the development of new technology for the industry.64 Manufacturing expertise and the construction of new fabrication facilities drive infrastructure development. The demands of manufacturing advance have conditioned the development of the nation’s semiconductor technology infrastructure (i.e., suppliers of manufacturing equipment, test equipment, and materials). Should the locus of manufacturing continue to shift overseas, it will erode this process of technology and infrastructure development associated with manufacturing.65

In part, the trend toward expanded overseas manufacturing reflects the global scale of the industry and its rising capital costs for fabrication facilities. This trend also reflects the active industrial policies of leading East Asian economies.66 The combination of greater vertical specialization and the impact of national policies to support local growth of the industry are changing the competitive environment. Increasingly, U.S. producers face challenges from the substantial capacity generated by government-supported fabrication facilities abroad.67 The

recovery of the U.S. industry, described below, does not mean that its current competitive strength can be taken for granted.68

A related issue of significant concern is the impact of these trends on the R&D funding that drives the industry. To date, the foundries have tended to be fast followers—rapidly adopting the new manufacturing technologies that drive the industry but making relatively modest R&D investments of their own. As the foundries gain market share, it is not clear whether the R&D investments required to sustain the industry’s exceptional growth will continue to be made.69

CHALLENGES OF MAINTAINING SUFFICIENT HUMAN CAPITAL

The unprecedented technical challenges faced by the industry underscore the need for talented individuals—the so-called “architects” of the future—to devise new solutions to these technical challenges.70 This need is emerging at the same time as the pool of available skilled labor is shrinking. There is widespread concern about the supply of workers and researchers for the semiconductor industry. Almost without exception, top management and researchers from the leading consortia and companies expressed misgivings about the adequacy of the labor force to meet foreseeable demand as the industry begins to recover from its current steep cyclical downturn. The increasing technical challenges faced by the industry are compounding this need and may make competition for skilled labor an integral part of international competition within the industry.

Historically, the U.S. government has supported human resources through its system of funding basic research at universities, whereby the work and training of graduate students and postdoctoral scholars are supported by research grants to principal investigators. However, the rapid growth in demand for skilled engineers, scientists, and technicians is generating challenges for the industry and national policy on several fronts.

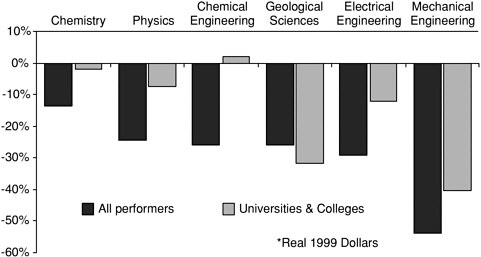

In recent years, federal funding for university research has declined steeply in sciences relevant to information technologies—such as mathematics, physics, and engineering (See Figure 8). This falloff in U.S. production of undergraduate

FIGURE 8 Real Changes in Federal Obligations for Research FY 1993–1999 (Real 1999 Dollars).71

engineers and graduate students in disciplines such as chemistry and physics is arguably linked to the decline in federal research support in these fields.

For more than a decade, U.S. graduate schools have depended on large numbers of foreign-born students and faculty to staff their laboratories and teach in their programs. The United States continues to attract foreign students, as well as scientists and engineers, who want to study, live, and work here. Increasingly, this group of highly skilled workers encounters significant inducements to return home.72

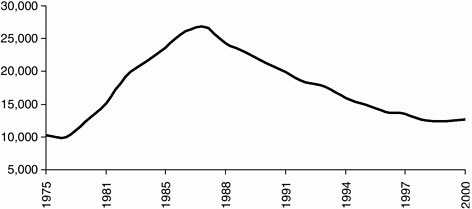

Most disconcerting from the U.S. perspective is the fact that the number of individuals graduating from U.S. universities with electrical engineering degrees has exhibited a declining trend since the mid-1980s (see Figure 9).73 Some well-

|

71 |

See M. McGeary and S.A. Merrill, “Recent Trends in Federal Spending on Scientific and Engineering Research: Impacts on Research Fields and Graduate Training,” Appendix A in National Research Council, Securing America’s Industrial Strength. Washington D.C.: National Academy Press, 1999. |

|

72 |

See Howell, op. cit. |

|

73 |

In 1988 approximately 24,000 people graduated from U.S. universities with bachelor’s degrees in electrical and electronic engineering. By 1997 this total had fallen below 14,000, and it is not forecast to increase significantly in the foreseeable future, whereas current estimates put the production of engineers in China at about 150,000 per year. Engineering Workforce Commission statistics and SRC projections presented by Dr. Michael Polcari of IBM at the Symposium on National Programs to Support the Semiconductor Industry, October 2000. |

FIGURE 9 Electrical Engineering Graduates: Bachelor’s Degrees Earned, 1975-2000.

SOURCE: National Science Foundation, Science & Engineering Indicators 2000, 1975-1987 Engineering Workforce Commission 1988-2000.

informed industry representatives see a growing problem. For example, John Kelley of Novellus observes that the problems facing the supplier industry are “fairly simple and straightforward.” The first is the undersupply of talented graduate students. He said that the good news is that many of the students they have hired trained through the Semiconductor Research Corporation (SRC) and were prepared to “hit the ground running.” The bad news is that there are not enough of them, and the situation seems to be worsening. Many graduates have moved away from the semiconductor industry into other areas, such as nanotechnology, he said, and the professors have been going “where the money is.”74

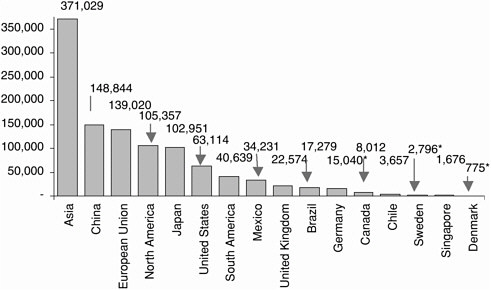

In the sheer production of engineers, the United States lags its current and future competitors in the microelectronics industry (See Figure 10). Japan now produces about 63 percent more engineers per year than the U.S., while China produces more than twice as many—roughly 136 percent more.75 While there may be issues of quality and industry-related experience, in sheer numbers Asia

FIGURE 10 Number of First University Degrees in Engineering, 1997.

*Long Degree programs

SOURCE: National Science Foundation, Science & Engineering Indicators 2000.

as a region produces more engineers per year than the United States by almost a factor of six. The European Union produces more than double the U.S. output of engineers.76

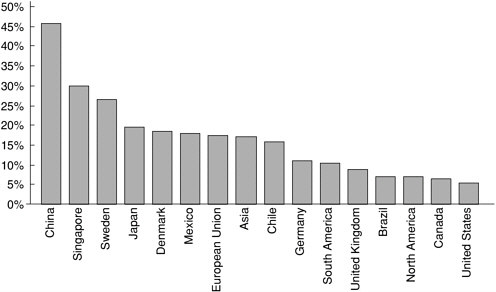

In terms of the percentage of bachelor’s degrees awarded each year in engineering (out of the total number of bachelor’s degrees in the U.S.) compared to equivalent degrees and 4 to 6-year programs in other nations, the U.S. lags far behind (see Figure 11).77 Almost half—roughly 46 percent—of all bachelor’s

|

|

is indeed some evidence of tightness in labour markets for particular categories of IT workers,” and further suggests that “the main issue of concern for policy makers and firms should be the gap be-tween the skills of current and future IT workers and those sought by firms.” For the details of this analysis see Vladimir Lopez-Bassols, “ICT Skills and Employment,” STI Working Papers. Director-ate for Science, Technology, and Industry, OECD, DSTI/DOC (2002) 10, July 17, 2002. See also National Science Foundation, Division of Science Resources Statistics, Science and EngineeringDegrees: 1966-2000. NSF 02-327, Author, Susan T. Hill (Arlington, Va 2002) <http://www.nsf.gov/sbe/srs/nsf02327/pdf/nsf02327.pdf>. |

FIGURE 11 Percentage of Bachelor’s Degrees in Engineering, 1997.

SOURCE: National Science Foundation, Science & Engineering Indicators 2000.

degrees in China each year are in the field of engineering, while the latest data show that out of all U.S. undergraduates each year, about 5 percent earn degrees in engineering. In terms of relative production of engineers (i.e., taking the ratio of engineering degrees to total degrees in each nation and then comparing it across countries) China outpaces the United States by more than 8.5 times, while countries such as Sweden and Japan outperform the United States by about 5 times and 3.7 times, respectively.78

These calculations are, of course, indicative of broad trends and make no qualitative assessment. They also reflect, at least in some cases, the national priorities of countries eager to master the technical requirements of the modern economy. Still, the disparities in the education of engineers are striking. Perhaps more of a cause for concern is that the declines in training of U.S. students in these fields are not based on estimates of national needs, but rather the result of unplanned reallocations of resources resulting from the post Cold War adjustments to the U.S. innovation system.79 Over time, the results of these reductions

may affect the ability of the United States to maintain its leading position in semiconductors, computers, and related industries, with potentially significant consequences for the nation’s level of economic growth and national security.

NATIONAL PROGRAMS TO SUPPORT THE SEMICONDUCTOR INDUSTRY

The conviction that high-technology industries are fundamental to technological competency, national autonomy, economic growth, and high-wage, high-value-added employment is widespread in the global community and not least among the major trading partners of the United States.80 Reflecting this conviction, many countries devote substantial resources to support and sustain high-technology industries within national and regional economies. “Governments believe that the future of their countries depends on the composition of their economies, and for the most part they see their success as nations defined by their relative success in these specific efforts.”81 This belief has stimulated increasingly vigorous international competition, especially in sectors that countries deem to be economically strategic.82 Consequently, many governments have adopted policies to support nationally based firms in the hope of capturing the benefits of this industry, such as higher-wage jobs, increased competitiveness, and future government revenue. Information technology industries are often a target of these national policies. For example, as Laura Tyson noted in her 1992 study:

The semiconductor industry has never been free of the visible hand of government intervention. Competitive advantage in production and trade has been heavily influenced by policy choices, particularly in the United States and Japan. Some of these choices, such as the provision of public support for basic science, R&D, and education in the United States, have had general, not industry-specific objectives. But other choices, such as the provision of secured demand for industry output through military procurement in the United States and through preferential procurement of computers and telecommunications equipment in Japan, have been industry specific in intent and implementation.83

As Tyson notes, the U.S. government provided early procurement-based funding to promote the development of semiconductors for both military and space exploration programs.84 The U.S. government’s subsequent role in assisting the commercial semiconductor sector was more controversial and more restrained.85 However, the fall-off in R&D support identified above is not confined to semiconductors. The United States has also reduced the scale of its R&D investment in computers and computer architecture, in both absolute and relative terms.86 The explanation for these reductions is complex, but these U.S. reductions run contrary to global trends. The lag effects of what have been described as “random disinvestments” may compromise the U.S. government’s ability to achieve other societal goals over the long term.

In contrast, governments abroad are active in supporting their respective industries, notably semiconductors, as Box C indicates. It is important to recall that this policy interest and support is not a new development. The Japanese government, for example, recognizing the country’s position as a late entrant in semiconductors, adopted a series of policies to jump-start its industry in the 1970s. Under the guidance of the Ministry of International Trade and Industry (MITI), the country made a sustained effort to promote a vibrant domestic semiconductor industry, notably through the successful VLSI Program.87 In addition, the verti

cally integrated structure of Japanese industry with its lower-cost capital proved to be a major advantage with respect to the capital-intensive investments required for manufacturing facilities, especially for DRAMs (Dynamic Random Access Memory), the technology driver at the time.88 Competition in semiconductors in the early 1980s was thus characterized—to a considerable extent—by DRAM “capacity races.”89 Aided by lower capital costs and less constrained by capital markets, Japanese firms undertook a massive capacity build-up in the early 1980s, accelerating their gains through highly aggressive price-cutting. The worldwide DRAM market share of U.S. industry sank from roughly 90 percent in the late 1970s to less than 10 percent by 1984-85, with many U.S. firms exiting the DRAM market entirely.90 The drastic effects of the Japanese competition led many informed U.S. observers to question the future viability of the U.S. semiconductor industry.91

U.S. Policy Initiatives

As competition from the Japanese producers intensified in the 1980s, the industry launched a series of initiatives, some in cooperation with the government, to strengthen its domestic capabilities (e.g., the Semiconductor Research Corporation) and later to stop what it considered to be unfair trade practices by Japanese producers through a series of bilateral trade agreements.92 The range of these initiatives, as shown in Box B, was extensive.

|

Box B Industry-Government Cooperation on Semiconductorsa

|

|

||||||||||||||

Reducing Legal Constraints on Cooperative Research

In addition to concerns about foreign trade practices, there was a widespread perception in the 1980s that U.S. technological leadership was slipping and that greater cooperation among companies would be required. Existing antitrust laws and penalties were seen as too restrictive and as possibly impeding the ability of U.S. companies to compete in global markets. This perception resulted in the passage of the National Cooperative Research Act (NCRA) in 1984. This act encouraged U.S. firms to collaborate on generic, pre-competitive research. To gain protection from antitrust litigation, NCRA required firms engaging in research joint ventures to register them with the U.S. Department of Justice. By the end of 1996, more than 665 research joint ventures had been registered. Among these, SEMATECH has perhaps been one of the most significant private R&D consortia.93 In 1993, Congress again relaxed restrictions—this time on cooperative production activities—by passing the National Cooperative Research and Production Act, which enables participants to work together to apply technologies developed by their research joint ventures.94

Trade Agreements

Efforts to address issues in U.S. manufacturing quality (see below) proceeded in parallel with efforts to resolve questions about Japan’s trading practices. A series of trade accords between Japan and the United States did not resolve trade frictions between the two countries, nor did the agreements redress the steadily declining U.S. market share. As a result, a near-crisis sentiment spread through the U.S. industry during the mid-1980s.95 At the urging of the industry, the federal government took several policy initiatives designed to support the U.S. industry.

After several unsatisfactory trade accords, there was a significant shift in U.S. policy on trade in semiconductors, notably through the conclusion of the 1986 Semiconductor Trade Agreement (STA) with Japan.96 The agreement sought to improve access to the Japanese market for U.S. producers and to end dumping (selling products below cost) in U.S. and other markets.97 After President Reagan’s decision to impose trade sanctions, the STA brought an end to the dumping in the U.S. and other markets and succeeded in obtaining limited access to the Japanese market for foreign producers, in particular, Korean and, later, Taiwanese DRAM producers.98 In fact, one of the most significant impacts of the accord was that it established a price floor for DRAMs, thus encouraging new entrants and, thereby, making the global DRAM market competitive once again.

As Laura Tyson points out, the trade agreement was a first in many respects. It was the first major U.S. trade agreement focused on a high-technology, strategic industry, and the first one motivated by concerns about the loss of competitiveness rather than the loss of employment.99 It was unusual in that the agreement concentrated on improving market access abroad rather than restricting access to the U.S. market. And unlike other bilateral trade deals, it sought to regulate trade (i.e., end dumping) not only in trade between the United States and Japan but in other global markets as well. It also included, for the first time, the threat of trade sanctions should the agreement not be respected. As such, it signaled a significant shift in U.S. trade policy.100

The Creation of SEMATECH

A second major step in this regard was the industry’s decision to seek a partnership between the government and a coalition of like-minded private firms to form the SEMATECH consortium, whose purpose was to revive a seriously weakened U.S. industry through collaborative research and pooling of manufac

turing knowledge.101 A central element of the challenges facing the U.S. semiconductor industry was manufacturing quality. By the mid-1980s, the leading U.S. semiconductor firms had recognized the strategic importance of quality and begun to initiate quality improvement programs. A key element in this effort was the formation of the consortium, which in part reflected the belief that the Japanese cooperative programs had been instrumental in the success of Japanese producers.102

The decision to form the SEMATECH consortium represented a significant new experiment in government-industry cooperation in technology development. The Silicon Valley CEOs of the U.S. semiconductor companies hesitated about cooperating with each other, and they were even more hesitant about cooperating with the government—an attitude mirrored in some quarters in Washington.103 Despite these hesitations, the consortium was conceived and funded under the Reagan administration. The formation of the consortium represented an unusual collaborative effort, both for the U.S. government and for the fiercely competitive U.S. semiconductor industry.104

This unprecedented level of cooperation, and the important corresponding collaborative activity among the semiconductor materials and equipment suppliers, appear to have contributed to a resurgence in the quality of U.S. products and, indirectly, to the resurgence of the industry.105 The collective accomplishments and impact of this cooperative activity appear to have been an essential element contributing to the recovery of the U.S. industry. Still, it should be underscored that the consortium’s contribution and other public policy initiatives were by no means sufficient to ensure the industry’s recovery. Essentially, these public policy initiatives can be understood as having collectively provided positive framework conditions for private action by U.S. semiconductor producers.106

From the government’s perspective, its support for the consortium enabled it to achieve a substantial number of strategic goals. From the industry’s perspective, the consortium contributed substantially to improvements in product quality and strengthened the U.S. equipment and supply industry. In combination with the Semiconductor Trade Agreements, the U.S. industry was able to increase its market share in Japan to over 20 percent by December 1992.107 Perhaps the most appropriate measure of SEMATECH’s contribution is the reaction of the market itself—that is, the willingness of industry participants to continue to provide matching funds over a sustained period; and then for these same firms to continue to fund the consortium with private resources and expand it with new members. The emulation of the consortium model by other nations represents an important development.

Expanding National Programs

In spite of the recent, pronounced downturn in the global semiconductor market, many governments remain active in their support of initiatives to promote the development of advanced microelectronics technology. Others steadily provide substantial incentives to add national industry manufacturing capacity (See Box C). Some nations are also providing substantial incentives to attract native-born and foreign talent to their national industry, in order to meet what some see as an emerging zero-sum competition for skilled labor.108 In doing so, some national programs are altering the terms of global economic competition with policies that differ in important ways from those of the traditional leaders.109

The levels of investment and promotional activity across many countries attest to the importance governments attach to this industry. An important development is the emergence of China, which for reasons of scale and skill is likely to pose a major competitive challenge. This is especially true as cooperation increases with the highly competent Taiwanese industry, a trend which has accelerated dramatically as a result of an influx of foreign investment and skilled manpower. At present China represents a small part of the world semiconductor market, but much new capacity is scheduled to come onstream.110 This expansion reflects a new Chinese government promotional effort designed to replicate Taiwan’s success in microelectronics on a much larger scale in China, drawing heavily on Taiwanese and other foreign capital, management, and technology. China’s new policy measures closely resemble those utilized by Taiwan, including the establishment of science-based industrial parks, tax-free treatment of semiconductor enterprises, passive government equity investments in majority pri

vately held semiconductor companies, and preferential financing by government banks.111

The sudden emergence of China as a significant site for semiconductor manufacturing is significant, but China is by no means the only player. Malaysia has opened a $1.7 billion wafer fab and has planned to construct two more.112 In Taiwan, planners in mid-2000 envisioned that a total of 21 new 300-mm fabs and 9 new 200-mm fabs would be built by the year 2010.113 These plans have been significantly reduced as Taiwan’s government planners seek to adjust to the growing migration of the island’s semiconductor manufacturing operations to China. Specifically, the government hopes to sustain a high concentration of 12-inch wafer fabs on the island, to enhance Taiwan’s capabilities with respect to systems-on-a-chip, and to improve Taiwan’s position in upstream (materials and semiconductor manufacturing equipment) and downstream (assembly, test, packaging) functions. The government of Singapore has publicly set a goal of 20 fabs by the year 2005. In South Korea, the government pressured commercial banks to finance the move into chip making by the country’s family-controlled conglomerates.114 In the proceedings for this report, speakers from Japan describe that nation’s vigorous attempt to bring about a “national revival” in microelectronics. In addition to the programs described above, Japan has launched a number of government-supported industry-government R&D projects in 2001-2002. For example, the Millennium Research for Advanced Information Technology (MIRAI) was initiated by METI in 2001 to develop next-generation semiconductor materials and process technologies, such as measuring and mask technology

|

111 |

The principal Chinese policies are spelled out in the Tenth Five Year Plan (2001-2005)— Information Industry, <http://www.trp.hku.hk/infofile/china/2002/10-5-yr-plan.pdf>, and Circular 18 of June 24, 2000, Several Policies for Encouraging the Development of Software Industry and Integrated Circuit Industry, published in Beijing Xinhua Domestic Service, 04:49 GMT, July 1, 2000. The municipal governments of Shanghai and Beijing have issued their own circulars articulating promotional policies to be implemented within their jurisdictions to augment the national-level measures. These are, respectively, Shanghai Circular 54 of December 1, 2000, Some Policy Guidelines of This Municipality for Encouraging the Development of the Software Industry and the Integrated Circuit Industry, Shanghai Gazette, January 2001; and Beijing Circular 2001-4, Measures for Implementing ‘Policies for Encouraging the Development of Software and Integrated Circuit Industries’ Issued by the State Council, Jing Zhen Fa No. 2001-4 (February 6, 2001). |

|

112 |

“The Great Chip Glut,” The Economist, August 11, 2001. <http://www.economistgroup.com>. |

|

113 |

According to the World Fab Watch (WFW) database, which is prepared by Strategic Marketing Associates and contains information on over 1,000 fabs worldwide, these estimates are subject to significant and sudden shifts, which has proved to be the case. Strategic Marketing Associates, World Fab Watch, Santa Cruz, CA, 2002. |

|

114 |

See Howell, op. cit. Howell’s figures and many of his conclusions are based primarily on personal interviews with industry officials in Asia. This type of field research on national policies for an industry is exceedingly rare in the U.S. |

|

Box C National Programs to Support the Semiconductor Industry Many nations are actively and substantially supporting initiatives in their respective national semiconductor industries. Some of these programs are listed below: A more complete list can be found in Thomas Howell’s analysis in this report.a

|

|

|

|||||||||||||||

for 50-nm generation devices.115 Many of these programs, at least in part, emulate the consortium model as well as other U.S. programs.116

This summary of national programs should not be interpreted as a criticism of them. The collective impact of these programs should help the semiconductor industry as a whole meet its increasingly complex technical challenges. At the same time, underlying these programs are genuine differences in national attitudes concerning a nation’s knowledge and technology base. Some nations believe the development of a nation’s manufacturing capacity in leading industries to be an appropriate national goal worthy of sustained support, a perspective apparent in policies of growing East Asian economies.117 Both European and Japanese industry leaders are identifying what they see as the main semiconductor growth markets of the twenty-first century—wireless, wired telecommunications, and digital home appliances. As one senior European participant observed, Europe in recent years has taken a leading position in several areas: communications, automotive electronics, smart cards, and multimedia. These applications are driven by system innovations on silicon and require embedded technologies. The next big cooperative challenge will be to develop systems-on-a-chip—achieving the same functionality in one-fiftieth the space. To meet this challenge, he

|

115 |

Government funding for this seven-year project was set at 3.8 billion yen for the first year. The project is being operated jointly by ASET and MITI’s new semiconductor R&D organization, Advanced Semiconductor Research Center (“ASRC”) in the Tsukuba Super Clean Room. MIRAI website, <http://unit.asit.go.jp/asrc/mirai/index.htm>; Handotai Kojo Handobukku (December 5, 2001), pp. 4-5. |

|

116 |

In 2002 METI launched a five-year industry-government R&D project to develop extremeultraviolet (EUV) lithography for 50-nm device manufacturing in conjunction with an association of 10 Japanese device and lithography equipment purchasers. The producers have formed the Extreme Ultraviolet Lithography System Development Association (“EUVA”) to undertake the project. First-year government funding was set at 1.09 billion yen. Japan Patent Office General Affairs Department Technology Research Division, Handotai Rokogijutsu Ni Kansaru Shutsugan Gijutsu Douko Chosa (May 10, 2001), p. 17; METI, Heisei Yonnendo Jisshi Hoshin (March 8, 2002), p. 1; Handotai Sangyo Shimbun (January 16, 2002), p. 3. In July 2000, 11 Japanese semiconductor manufacturers established a new R&D company, Advanced SoC Platform Corporation (“ASPLA”), to standardize design and process technologies for systems-on-a-chip utilizing 90-nm design rules. METI reportedly will provide 31.5 billion yen for this effort, which will feature partnership with STARC and Selete. See also the presentations of Masataka Hirose, Toshiaki Masuhara, and Hideo Setoya in the proceedings of this volume. |

|

117 |

Some nations pursue consumer welfare as an implicit, if vaguely defined, goal, while other nations adopt explicit national economic strategies, designed to pursue national economic strength through the acquisition of the capability to manufacture high-technology products. See National Research Council, Conflict and Cooperation in National Competition for High-technology Industry, pp. 12-27 and pp. 51-54. See also Richard Samuel’s Rich Nation, Strong Army: National Security and Technological Transformation of Japan, Ithaca, NY: Cornell University Press, 1994. |

said, Philips will cooperate in both MEDEA Plus and ITEA, the Information Technology for European Applications.118 U.S. companies have dominated computer applications of semiconductors, in particular personal computers. Growth prospects in these applications may prove to be more limited in the future.119

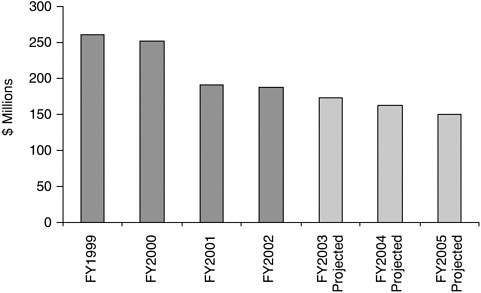

CHALLENGES TO U.S. PUBLIC POLICY

While federal funding for SEMATECH ended after 1996 at the industry’s request, the debate has continued within Congress and the Executive branch as to whether and to what extent the U.S. government should continue to invest federal funds in supporting R&D in microelectronics.120 Some observers argue that the role of the government support for R&D should be curtailed, asserting that federal programs in microelectronics represent “corporate welfare.”121 Advocates of R&D cooperation among universities, industry, and government to advance knowledge and the nation’s capacity to produce microelectronics argue that such support is justified, not only by this technology’s relevance to many national missions (not least, defense), but also by its benefits to the national economy and society as a whole.122

In fact, no consensus exists on the appropriate mechanisms or levels of support for research. Discussions of the need for such programs have often been dogged by doctrinaire views as to the appropriateness of government support for industry R&D and by domestic politics (e.g., balancing the federal budget) that have generated uncertainty about this form of cooperation, especially at the federal level.123 This irresolution has resulted in a passive federal role in addressing

|

118 |

See the presentation by Philips Semiconductor’s Peter Draheim in this volume. |

|

119 |

“From Stagnation to Growth, The Push to Strengthen Design,” Nikkei Microdevices (January 2001); “Three Major European LSI Makers Show Stable Growth Through Large Investments,” Nikkei Microdevices (January 2001). See also Howell, op. cit. |

|

120 |

At a meeting in 1994, the SEMATECH board of directors reasoned that the U.S. semiconductor industry had regained strength in both the device-making and supplier markets, and thus voted to seek an end to matching federal funding after 1996. For a brief timeline and history of SEMATECH, see <http://www.sematech.org/public/corporate/history/history.htm>. |

|

121 |

See Rodgers, op. cit. |

|

122 |

Policy debates on public-private partnerships have often suffered from sloganeering, with no clear resolution. One side claims that the market is efficient and will therefore sort itself out without the involvement of government. The other side counters that markets are imperfect and that, in any event, government missions cannot depend on markets alone, nor can they wait for the appropriate price signals to emerge. Therefore public policy has a role—and always has. One contribution of this analysis, and of others in the series, is to document current cooperative activity and redirect attention away from this abstract rhetoric and demonstrate that carefully crafted partnerships can help accelerate innovation. |

|

123 |

See David M. Hart, Forged Consensus: Science, Technology, and Economic Policy in the United States, 1921-1953, Princeton: Princeton University Press, 1998, p. 230. For a broader review of these differing perspectives, see Richard Bingham, Industrial Policy American Style: From Hamilton to |

FIGURE 12 Defense Advanced Researech Projects Agency’s Annual Funding of Microelectornics R&D.

SOURCE: DARPA

the technical uncertainties central to the continued rapid evolution of information technologies. Annual funding of microelectronics R&D through DARPA—the principal channel of direct federal financial support—has declined and is projected to decline further (see Figure 12).124 As noted above, this trend runs counter to those in Europe and East Asia, where governments are providing substantial

direct and indirect funding in this sector. The declines in federal funding for research are of particular concern to U.S. industry.

Cooperative Research Programs

Continuing to advance microelectronics technology is becoming increasingly difficult. As semiconductors become denser, faster, and cheaper, they approach physical limits that will prevent further progress based on current chip-making processes. Significant research breakthroughs will be required to allow historic trends to continue; yet if these occur, in 15 years semiconductor memory costs could be one one-hundredth of today’s costs and microprocessors 15 times faster.

Reflecting this concern, the industry has initiated several new programs aimed at strengthening the research capability of U.S. universities. The largest of these, carried out under MARCO (the Microelectronics Advanced Research Corporation), is the Focus Center Research Program (FCRP). In this program, the U.S. semiconductor industry, the federal government, and universities collaborate on cutting-edge research deemed critical to the continued growth of the industry (see Box D). As an industry-government partnership supporting university research in microelectronics, the FCRP research is long range (typically eight or more years out) and essential for the timely development of a replacement technology for the current chip-making process.125

There are currently four focus centers, addressing design and test; interconnect; materials, structures and devices; and circuits, systems, and software. The four focus centers now involve 21 universities. A brief description of each of the centers is provided in Appendix A. The FCRP plans to eventually include six national focus centers channeling $60 million per year into new research activities. However, the sharp downturn in the industry may jeopardize this commitment, and the federal government’s commitment is also in doubt. The industry funds 75 percent of the program, and the government has funded the remaining 25 percent. The government’s share has been supported through the Government-Industry Co-sponsorship of University Research (GICUR) program within the Office of the Secretary of Defense. When the industry and government embarked on the FCRP, the plan outlined a ramp-up which would now require $10 million in funds for semiconductors in 2003, $12 million in 2004, $13 million in 2005,

|

125 |

The FCRP is part of MARCO, the Microelectronics Advanced Research Corporation, within the SRC. See MARCO website, <http://marco.fcrp.org>. MARCO has its own management personnel but uses the infrastructure and resources of the SRC. MARCO’s supporters include the following: Advanced Micro Devices, Inc., Agere Systems, Agilent Technologies, Analog Devices, Inc., Conexant Systems, Inc., Cypress Semiconductor, IBM Corporation, Intel Corporation, LSI Logic Corporation, MICRON Technology, Inc., Motorola Incorporated, National Semiconductor Corporation, Texas Instruments Incorporated, Xilinx, Inc., Air Products & Chemicals, Inc., Applied Materials, Inc., KLA-Tencor Corporation, Novellus Systems, Inc., SCP Global Technologies, SpeedFam-IPEC, Teradyne, Inc., DARPA, and the Deputy Undersecretary of Defense for Science & Technology. |

|